To connect a POS (Point of Sale) device to the BASE24 switch, several steps are involved. The process ensures secure communication and proper transaction routing. Below is the detailed initial process to start connecting with a TID (Terminal ID).

Here’s a flowchart for the POS Terminal Test Transaction Process with BASE24:

1️⃣ POS Initialization → 2️⃣ Network Connection Setup → 3️⃣ Authentication with Host → 4️⃣ Send Test Transaction → 5️⃣ Receive Response → 6️⃣ Success or Failure Handling

In BASE24, TSS stands for Transaction Security Services.

TSS is used for transaction security and encryption in BASE24 systems, ensuring secure communication and data protection in financial transactions. Let me know if you need more details!

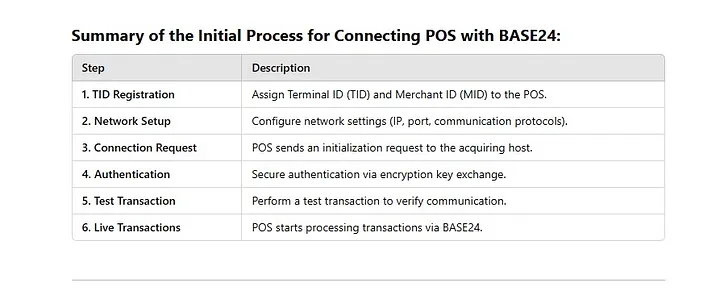

- Device Configuration and Registration

Before a POS device can communicate with BASE24, it must be configured and registered with the acquiring host.

TID Assignment:

- Each POS terminal is assigned a unique Terminal ID (TID) by the acquiring bank or processor.

- The TID helps identify the specific POS terminal in transaction processing.

MID (Merchant ID) Assignment:

- The POS terminal is also linked to a Merchant ID (MID), which identifies the merchant location.

Network Configuration:

- The POS device is configured to use Ethernet, Wi-Fi, or GPRS/4G to communicate with the acquiring bank or BASE24 switch.

- Secure network parameters (IP address, port, host settings) are loaded into the POS device.

2. Establishing Connection with BASE24

Once the device is configured, it attempts to establish a connection to BASE24 through the acquiring host.

Terminal Initialization Request:

- The POS device sends an initialization request to the acquiring host with the TID, MID, and encryption keys.

- This request helps the host validate the device and configure transaction parameters.

Summary of the Initial Process for Connecting POS with BASE24:

Host Response:

- The acquiring host checks the TID and MID against the registered database.

- If valid, the host responds with necessary parameters such as:

- Accepted card types (#Visa, #MasterCard, etc.).

- Communication settings.

- Encryption keys for secure transactions.

3. Security and Mutual Authentication

Before transactions can be processed, mutual authentication is performed to secure communication between the POS device and BASE24.

Encryption Key Exchange:

- The POS terminal and host perform a key exchange for encryption.

- Secure keys such as #DUKPT (Derived Unique Key Per Transaction) or 3DES encryption are used.

Challenge-Response Authentication:

- The host sends a challenge request to the POS terminal.

- The POS device responds with an encrypted message using stored cryptographic keys.

- If authentication is successful, the POS terminal is allowed to process transactions.

4. Test Transaction and Connectivity Verification

Before going live, a #testtransaction is performed to ensure smooth communication between the POS and #BASE24.

- A dummy transaction (e.g., Reversal or Balance Inquiry) is sent to BASE24.

- If the response is successful, the POS is ready for live transactions.

5. Live #Transaction Processing Begins

Once the POS device is fully initialized and authenticated, it can start processing transactions in real-time through BASE24.

Key Takeaways:

- TID (Terminal ID) uniquely identifies the POS device in the BASE24 network.

- Mutual authentication ensures a secure connection between POS and BASE24.

- Encryption keys protect transaction data from fraud and attacks.

- Test transactions confirm that the POS terminal is ready for live transactions.

#technicalgranth #Terminal #POS #TerminalTID #MID #MerchantMutualauthentication #Encryptionkeys